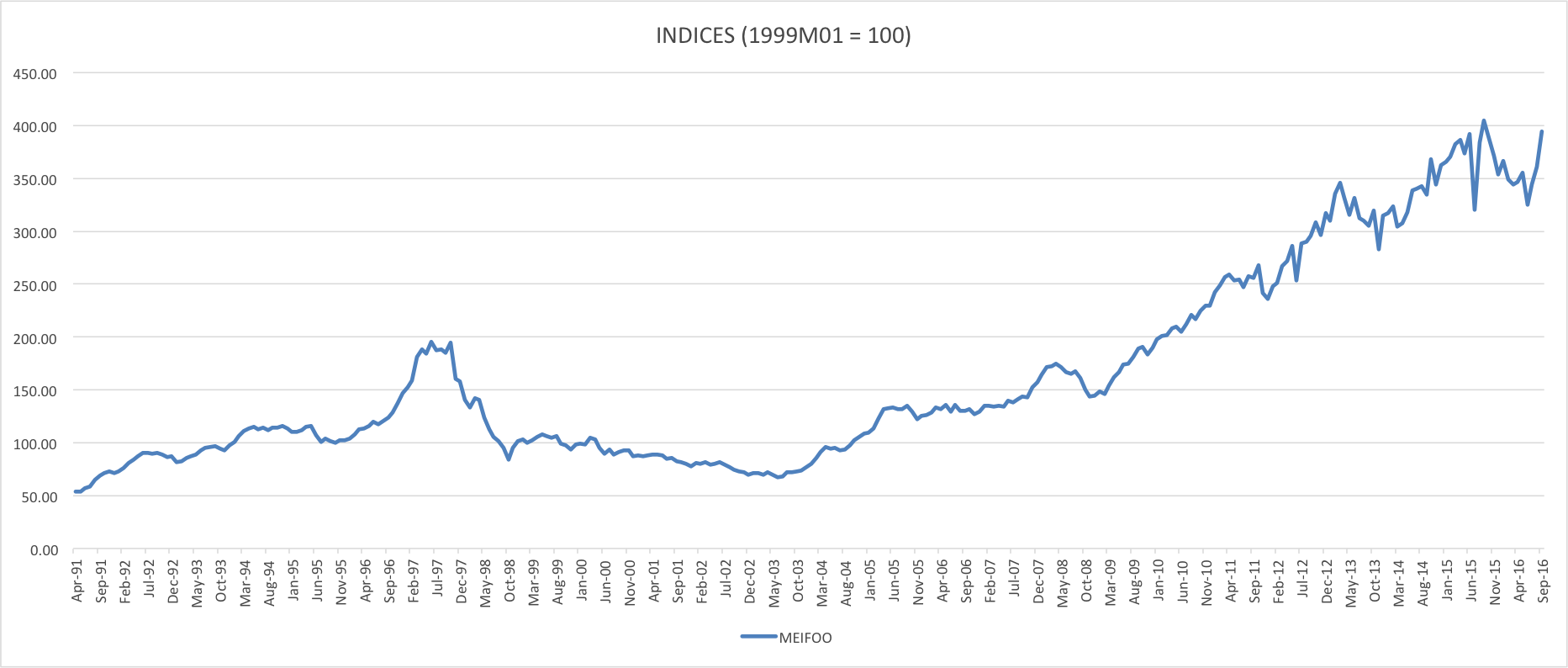

MEI FOO SUN CHUEN’s Price Index (since 1991)

Our Interpretation

In macroeconomy, property price is a supply and demand function. From the price indices generated, there are some notable points that can be identified from the index trend in Mei Foo Sun Chuen. Below provides an explanation for such trends.

Peak in 1997

The price index first reached a peak in the third quartile of 1997. On the demand side, macroeconomic factors such as income growth, low unemployment rate and interest rate increase the demand for residential properties. This promoted the property price growth in 1990s until late 1997. Immigration is another important factor contributing to the increased housing demand. Immigrants from Mainland in the 1980s and 1990s create more households in Hong Kong, which in turn drove up the demand for housing.

On the supply side, from the Sino-British Joint Declaration, only 50 hectares of land was imposed on land sales annually from 1985. The limit was relaxed in 1994 and 1 July 1997 respectively. With a limited supply of land for housing, the rocketing demand in the 1980s and 1990s can hardly be satisfied, resulting in a property price boom in the early 1990s. The supply of public housing, either public rental housing or subsidised home ownership schemes, has slowed down in the 1990s. This further increase the demand for private units.

In addition to the basic supply and demand explanations, increased speculative activities also contributed to the property price peak in 1997. It was argued that a property bubble was developed in the 1990s. This can be shown by the affordability, measured in the ratio of per capita GDP to property prices. The affordability reached a trough in 1997, indicating that there was likely a property bubble.

All the factors combined, the residential property price reached a peak in 1997. Mei Foo Sun Chuen, as one of largest private housing estate in Hong Kong, was inevitably affected by these factors and reached a peak price in 1997.

Downturn in 1998 – 2003

Following the Asian Financial Crisis triggered in July 1997, the real interest rate rose as economic activities contracted.

On the supply side, then chief executive Tung Chee-hwa pledged in 1997 to construct 250,000 units of residential properties in the next ten years (HKMA, 2002). These caused a downturn for the residential housing market starting from 1998. Many homeowners suffered from negative-equity mortgages because of this.

In 2003, the outbreak of SARS further made investor lose confidence in the Hong Kong housing market and depressed the secondary housing market. The combined effect was that the property price of Mei Foo Sun Chuen hit a bottom in 2003.

Peak and Sudden Drop in 2008

Since the outbreak of SARS in 2003, the economy of Hong Kong revived with the help of various government policies. Expansion of Mortgage Insurance Programme helped increase the end-user demand. The Individual Visit Scheme launched in July 2003 allowed Mainland visitors to access Hong Kong individually. This helped raise the investor’s confidence in the Hong Kong property market and hence increased the housing demand from the Mainland. Together with a generally positive attitude towards the economy in Hong Kong, the property price in Mei Foo Sun Chuen reached a peak in mid-2008.

The downturn of residential property price in late 2008 was mainly triggered by the Global Financial Crisis in late 2008. The negative effect spilled over to Hong Kong’s economy and resulted in a sudden drop in residential property price from late 2008 to early 2009.

Downturn in early 2013

The property price experienced a general rising trend after the sudden drop in 2009 until another sudden drop in late 2012. This is due to the introduction of Special Stamp Duty and Buyer’s Stamp Duty with effects on October 2012. The Stamp Duties target speculators by increasing transaction costs of residential properties. This resulted in a downward trend in property price in Mei Foo Sun Chuen in 2013.

From 2013 – Now and Future

From the index trend, it is observed that the property price market is experiencing a slower growth or even a downturn from early 2015 to early 2016

Chief Executive CY Leung committed to provide 470,000 new housing units in 10 years, including public and subsidised housing in the 2013 Long Term Housing Strategy Consultation Document. This would mean that a surge in housing units could be expected.

Besides, the Chinese government has intensified the crackdowns on the wealthy in the Mainland with various anti-corruption campaign. This has reduced the amount of capital entering the Hong Kong market. The economic slowdown in Hong Kong in recent years also resulted to a slower growth in residential property prices.

More recently, on 4 November 2016, the government announced that the Special Stamp Duty Rate will be increased to a flat rate of 15%. In light of this, it is expected that the residential property market will be further cooled down. Meanwhile, in a more macro view, with the new President Trump entering the White House next year, while it is still unclear what interest rate policy Trump is going to propose, rumour has it that the interest rate will remain low, which favours the growth of the property market. While the combined effects of the policies are still unclear, it is still believed that the residential property price will not experience a drastic growth due to the cooling measures and the increasing supply of housing units. Therefore, the growth of property price in Mei Foo Sun Chuen in the near future will also be slowed down.