VE Price Index

Overview

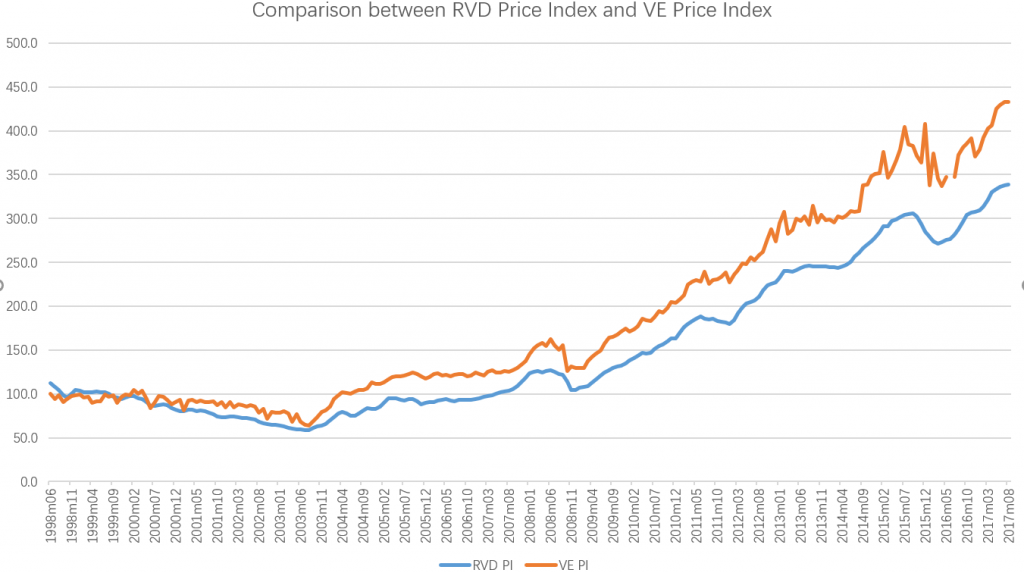

Villa Esplanada (VE) Price Index shows the price index of each individual month starting from June, 1998. The price index is set at 100 as the benchmark in June, 1998.

With the use of hedonic price model, the price index of each individual month afterwards until the latest transaction date in August 2017 is derived from the coefficient of the corresponding time dummy.

RVD PI = Rating and Valuation Department Price Index (Private Domestic, Territory-Wide, All Classes)

VE PI = Villa Esplanada Price Index

Our Interpretation

A decreasing trend in property prices is discovered in both RVD price index and VE price index from 1998 to 2003, possibly because of the economic depression since the Asian Financial Crisis in 1997. The prices hit the bottom in 2003 accompanied by the outbreak of SARS. However, the economy of Hong Kong gradually revived since then due to some policies, such as the introduction of Individual Visit Scheme and the Close Economic Partnership Arrangement (CEPA) with mainland China. Investors regained the confidence in real estate market in Hong Kong. Afterwards until August 2017, both price indices kept an overall steadily upward trend with some price fluctuations. A slight dip is discovered in both price indices in 2008-2009, which seems to be caused by the Global Financial Crisis at that time. Then, the prices bounced up again due to gradual economic recovery and climbed up at a relatively higher speed than before. Another round of remarkable price fluctuations in 2015-2016, possibly impacted by the unstable economic circumstances and rising US interest rates at that time, are also shown in RVD price index and VE price index.

Overall, the trends of both indices match with each other synchronously. Both the price indices show that the housing prices are going up more steeply with higher volatility after 2009 than in 2003-2008. Furthermore, the VE price index is generally more volatile than RVD price index. The possible major reason for that might be the difference of the transaction sample pools. RVD price index reflects the price level of all residential properties in Hong Kong, while the VE price index is only built based on the transaction samples of Villa Esplanada.