INTERPRETATION OF PRICE INDEX

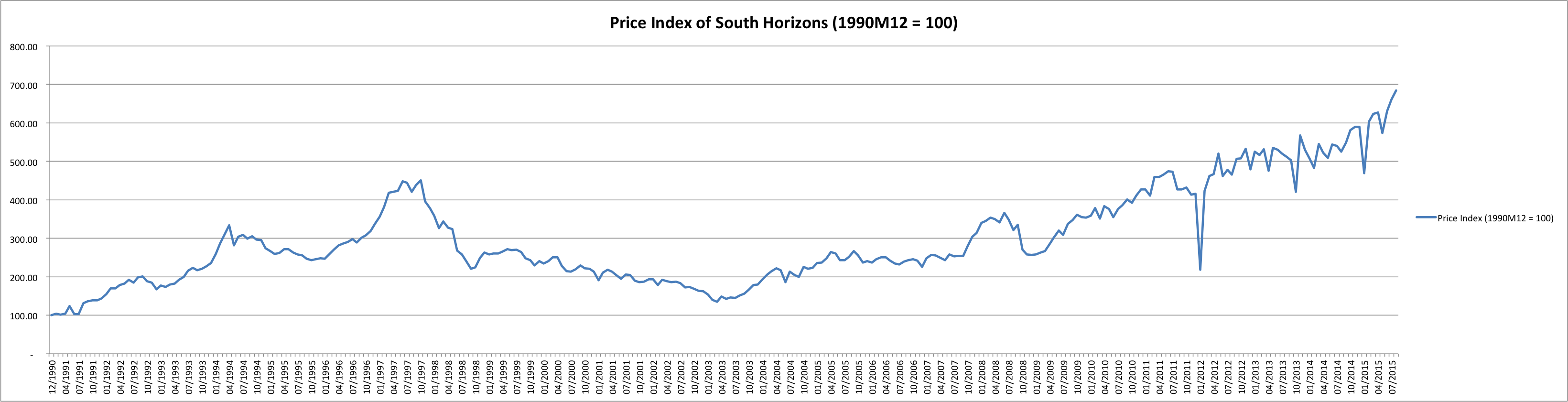

South Horizons is one of the largest housing estates in Hong Kong. Not only is the price of the subject housing estate is subject to macro changes, but also changes within the district. From 1991 to 2015, there have been several peaks and downturns which can be explained by certain big past events.

Peak in 1997

Since the launch of South Horizons 1991, the housing price has been rising significantly for more than 400% by 1997. With a favourable economic condition with low unemployment rate and rapidly growing market in early 1990s, a very low real interest was imposed with low nominal interest rate and high inflation rate, which was deemed as a driving force behind the rising of property price in Hong Kong. Such a low interest rate encourage people to do investment in the real estate market hence invited speculative activities and increased drastically the demand for property. The property price reaches the peak in late 1997. Property price of South Horizons was also impacted by this macro market changes and followed the big market trend.

Downturn in 1998 -2003

Yet in late 1997, the Asian Financial Crisis spread to Hong Kong. The stock market dropped significantly and the market condition became unfavourable. In addition with the introduction of the “85,000 public and private housing unit policy”, the demand for properties declined sharply. This brought the tremendous downturn of property price since 1998. Many homeowners’ assets became negative assets. The property price in Hong Kong had been slumping for the following 5 years. The outbreak of SARS in 2003 further compressed the property price to the lowest bottom in the decade with the minimization of transaction volume.

In such a recession of real estate market, property price of South Horizons also declined substantially and reached its bottom in 2003.

Small Peak in 2008

After the outbreak of SARS, the Hong Kong government has implemented several measures to boost the economy, including the Individual Visit Scheme. Since then, the economy in Hong Kong has recovered gradually. The upturn of economic conditions triggered people to regain confidence in the real estate market and buy flats, causing a gradual increasing trend. In 2008, Financial Crisis occurred and added downside impact on Hong Kong’s economy. The property market has suffered continued fall-off since then but for a short period of time. The property price dropped significantly by 25% yet bounced back and surged continuously.

Sudden Drop in Late 2012

To rein the rapidly increasing housing price, the Hong Kong government imposed property price cooling measures in October 2012 – Special Stamp Duty and Buyer’s Stamp Duty. These two measures aimed to deter speculative activities and stabilize the housing price. Minimizing the transaction volume, the demand from speculators and non-local buyers substantially declined in late 2012 immediately after the announcement of the cooling measures. As one of the biggest housing estates in Hong Kong, South Horizons’ transaction volume also shrank considerably under the effect of the cooling measures.

Rising Trend from 2007 – now

Since the announcement of the MTR South Island Line in October 2007, as one of the passing locations, the South Horizons’ property price has been increasing. The South Island Line (East) commenced construction in 2011 and would start its service by the end of 2016. The launch of MTR line has caused a significant surge in property price of South Horizons. It is expected that the property price of the housing estate would further escalate after the opening of the MTR line in 2016, given that the macro economic condition are kept constant.

Future Price Trend

By the end of 2016, the South Island Line would be in service. This enhancement in transportation brings in people to the Southern District and provides more convenience to the residents in South Horizons. It is expected that the property price of the housing estate would further escalate after the opening of the MTR line, given that the macro economic condition kept constant.

From a macro perspective, the general property price in Hong Kong is forecasted to be a declining trend. Since speculators and non-local residents are excluded from the real estate market due to the BSD and SSD, local demand for housing would have been satisfied. Those who hope for a flat now may have bought one and leave the market upon the completion of currently-constructing housing. In this case, the local demand for properties would shrink significantly and the supply of housing would be far more than the demand. Unless the government looses the property cooling measures, the property price in future few years after the completion of ongoing residential development projects would decline due to oversupply.

Back to Price Index.